Economy & Business

🛢Oil Prices Hit Multi-Week Highs Amid Dollar Dip and Trade Hopes

What’s Driving the Surge in Oil Prices?

Oil markets saw a sharp uptick today as:

- The U.S. dollar weakened, making oil cheaper for other currencies.

- US–China trade talks signaled potential thawing of tensions.

- Risk appetite increased among investors as equities rose globally.

This combined boost helped both Brent and WTI crude benchmarks notch multi-week highs.

Brent and WTI: Price Movements

- Brent crude: Surged above $67 per barrel

- WTI crude: Crossed $65 per barrel

These levels mark the highest since mid-April 2025, signaling a turnaround from recent stagnation caused by demand concerns and inventory builds.

Role of the U.S. Dollar and Market Sentiment

- A falling dollar index made oil more attractive to buyers holding other currencies.

- Global equity gains—especially post-London trade negotiations—have improved sentiment across risky assets including crude.

Geopolitical and Supply Factors at Play

- OPEC+ compliance remains high with no immediate plans to boost output.

- U.S. rig counts dropped marginally, tightening future supply expectations.

- Geopolitical calm in the Middle East has kept volatility subdued for now.

Impact on India: Fuel Prices & Trade Deficit

- Higher oil prices could pressure India’s import bill.

- Expect marginal increases in petrol and diesel prices at retail pumps.

- Rupee may face headwinds due to stronger dollar demand for crude purchases.

Economy & Business

From Amrit Bharat Trains to Road Infrastructure: PM Modi Unveils Projects Worth Over ₹7,200 Crore in Bihar

Big Boost for Indian Railways in Bihar: Trains, Tracks & Modernization

One of the event’s highlights was the launch of four new Amrit Bharat Express trains, symbolizing the railways’ reach into deeper Bharat. These semi-modern trains, designed for affordable comfort, will serve key Bihar routes:

- Rajendra Nagar (Patna) to New Delhi

- Bapudham Motihari to Anand Vihar Terminal

- Darbhanga to Lucknow (Gomti Nagar)

- Malda Town to Lucknow (via Bhagalpur)

Each train is expected to improve regional mobility for daily commuters, students, and small-business travelers—reducing dependency on slower express trains.

Other major railway projects launched include:

- Doubling of Darbhanga–Narkatiaganj lines

- Upgrades on Samastipur–Rambhadrapur and Darbhanga–Thalwara routes

- Modern signalling systems across 114 km of key rail corridors

- Energy-efficient electric traction enhancements

- Vande Bharat maintenance shed at Patliputra station, enabling local support for India’s fastest trains

This holistic railway investment will not only improve punctuality and reduce congestion but also prepare Bihar’s tracks for high-speed and high-frequency travel in the future.

Bihar’s Road Network Gets Major Facelift

In a state where many rural zones remain under-connected, road infrastructure is critical. PM Modi laid the foundation stone for several highway and bypass upgrades including:

- Ara Bypass (NH-319) four-laning project

- Improved Parariya–Mohania route, part of the east-west transport corridor

- Widening of Sarwan–Chakai (NH-333C), crucial for Bihar–Jharkhand freight traffic

These roads are vital for linking agricultural mandis, industrial areas, and border districts with national markets. Improved connectivity also ensures faster ambulance and emergency services, especially in flood-prone zones.

Rural Empowerment: Fisheries, Housing, and Women’s SHGs

Rural Housing Milestones:

- 12,000 new homes under PM Awaas Yojana were handed over symbolically

- ₹160 crore was disbursed to 40,000 rural families under PMAY-Gramin

Fisheries Projects under PM Matsya Sampada Yojana:

- Hatchery units, feed mills, and ornamental fish farms in Mithilanchal and Seemanchal

- Sustainable aquaculture for doubling fishermen’s incomes and creating employment in low-income regions

Women Empowerment via SHGs:

- Over ₹400 crore was released to Self-Help Groups (SHGs) through DAY-NRLM, touching the lives of over 10 crore rural women

- These funds will fuel women-led microenterprises in dairy, handicrafts, retail, and more

This layered model of development tackles poverty not just through handouts, but through enterprise, skill-building, and financial independence.

Technology and Startups Get a Launchpad

In a major signal to Bihar’s aspiring youth, the PM inaugurated:

- A new Software Technology Parks of India (STPI) hub in Darbhanga, serving North Bihar

- A startup incubation centre in Patna, expected to generate jobs in tech, AI, digital marketing, and rural e-commerce

These tech zones are expected to retain Bihar’s engineering and IT graduates, often forced to migrate to Bengaluru or Pune for jobs.

Strategic Timing: Bihar Assembly Polls in Sight

This massive ₹7,200 crore launch aligns closely with BJP’s messaging for the upcoming Assembly elections. PM Modi coined a new slogan from the stage:

Banayenge naya Bihar, phir ek baar NDA sarkar

He contrasted the current government’s ₹9 lakh crore funding since 2014 with the mere ₹2 lakh crore Bihar received in the decades before, accusing previous regimes of “neglect and corruption.”

Key political statements:

- Criticized RJD and opposition parties for “betraying the poor”

- Highlighted Nitish Kumar’s alignment with central policies as key to development

- Emphasized job creation, rural infrastructure, and urban connectivity as the path forward

CM Nitish Kumar, who shared the stage, praised the Centre for its focus on:

- Makhana Board for North Bihar exports

- Free power, canal irrigation, and new cold chains for agriculture

At a Glance: ₹7,200 Crore Development Blueprint

| Sector | Key Projects |

|---|---|

| Railways | Amrit Bharat trains, line doubling, Patliputra depot |

| Highways | NH-319 Ara Bypass, NH-333C Chakai road, Parariya–Mohania |

| Tech & Startups | STPI Darbhanga, Incubation Patna |

| Rural Housing | 12,000 homes + ₹160 cr to 40,000 families |

| Fisheries | Hatcheries, feed mills under PMMSY |

| Women’s SHGs | ₹400 cr to 61,500 groups |

| Political Messaging | “Naya Bihar” campaign push |

Final Word

The ₹7,200 crore project rollout by PM Modi in Bihar is a multisectoral, politically astute move that targets every segment: youth, women, farmers, urban commuters, and rural voters. It’s part public service, part campaign, and wholly strategic.

If successful, it could become a model for election-season development launches, merging governance with ground-level optics.

Economy & Business

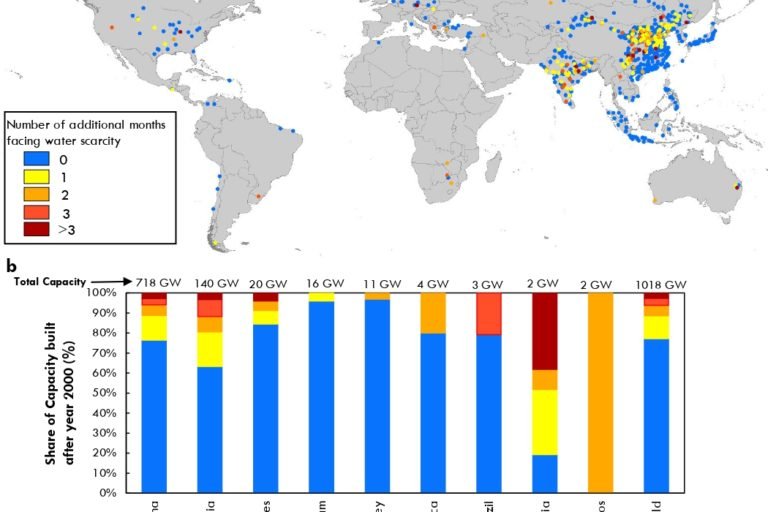

India’s Coal Power Boom Clashes with Water Scarcity in Vulnerable Regions

New Delhi – June 9, 2025: As India pushes forward with its energy expansion, a worrying clash has emerged between thermal power development and the nation’s water resources. The central government has greenlit ₹80,000 crore (approx. $9.6 billion) in new coal-fired power plants—44 in total—many of which are located in already water-scarce regions.

Environmentalists and policy experts warn that these projects could tip vulnerable ecosystems into crisis, threatening drinking water access, agriculture, and public health in nearby communities.

44 New Coal Plants—and Growing Risks

The Ministry of Power has fast-tracked construction of 44 new coal-fired thermal power plants, aiming to meet rising energy demand and reduce dependence on energy imports. However, a significant number of these projects are located in states like:

- Chhattisgarh

- Odisha

- Jharkhand

- Maharashtra

- Telangana

These are areas already grappling with seasonal droughts, falling groundwater tables, and poor water infrastructure.

Why Coal Power Consumes So Much Water

Thermal plants require vast quantities of water for cooling and steam generation. A single large coal plant can use up to 4–5 million litres of water per day. When dozens of such plants are concentrated in dry belts, local rivers and aquifers face irreversible depletion.

A recent study by the Centre for Science and Environment (CSE) found that over 40% of India’s thermal plants are located in “high water-stress” zones.

Communities Raise the Alarm

Farmers in Korba, Chhattisgarh—often dubbed the coal capital of India—have reported reduced irrigation water availability and recurring crop failures. “We used to get canal water, now it’s redirected to factories,” said Bhupendra Sahu, a local farmer.

In Odisha’s Angul district, tribal communities are staging protests, alleging that water from the Brahmani River is being prioritized for industrial use over drinking water needs.

Government’s Balancing Act

Union Power Minister R.K. Singh stated that “water-saving technologies” such as air-cooled condensers will be employed to mitigate risks. However, environmental groups argue that implementation is inconsistent and oversight is weak.

The National Water Mission has flagged concerns that energy sector growth is outpacing hydrological planning.

Experts Call for Policy Overhaul

Energy experts are urging the government to:

- Shift investment toward renewables and decentralised solar systems

- Conduct cumulative water impact assessments for thermal projects

- Strengthen community water rights and local governance

With climate change intensifying monsoon unpredictability, the risk of water-energy conflict is only growing.

Economy & Business

📈 Indian Stock Market Soars in June 2025 Amid RBI Rate Cut and Foreign Investment Boost

📈 Indian Stock Market Soars in June 2025 Amid RBI Rate Cut and Foreign Investment Boost

Focus Keyword: Indian stock market June 2025

SEO Title: June 2025 Indian Stock Market Rally Fueled by RBI Cut and FPI Inflows

Meta Description: Indian stock markets surged in June 2025, powered by RBI’s rate cut and strong foreign investor inflows. Sensex and Nifty hit fresh highs amid bullish sentiment.

Slug: indian-stock-market-june-2025-update

The Indian stock market experienced a strong upswing in June 2025, driven by favorable monetary policy decisions and renewed foreign investor confidence. Both benchmark indices — the BSE Sensex and NSE Nifty 50 — scaled fresh highs during the month, showcasing bullish sentiment among traders and investors.

🏦 RBI’s Game-Changing Policy Moves

On June 6, 2025, the Reserve Bank of India (RBI) surprised markets by cutting the repo rate by 50 basis points, bringing it down to 5.5%. In an additional boost, the central bank also slashed the Cash Reserve Ratio (CRR) by 100 basis points, infusing ₹2.5 lakh crore liquidity into the banking system.

These moves signaled a strong commitment toward economic revival and spurred fresh buying interest in rate-sensitive sectors like banking, auto, and real estate.

🌍 Foreign Portfolio Inflows Surge

June marked a major turnaround in foreign investor sentiment. After months of cautious stance, Foreign Portfolio Investors (FPIs) poured in approximately $2.3 billion into Indian equities, making it the highest monthly inflow since September 2024.

This influx was largely directed toward financials, IT, and FMCG sectors, reaffirming global investors’ long-term confidence in India’s growth story.

📈 Benchmark Indices Touch Record Highs

- Sensex: Jumped over 750 points on June 6 alone, closing at 82,194.00 — a record high.

- Nifty 50: Gained 250 points to close at 25,002.85, breaching the 25,000 mark for the first time.

This rally was underpinned by robust corporate earnings, dovish monetary policy, and global cues favoring emerging markets.

🏢 Key Stock Movers in June 2025

- HDFC Bank: Gained 2% following improved credit growth outlook.

- Bajaj Finance: Rose 4.2% amid bullish brokerage upgrades.

- Ashok Leyland: Jumped 3.4% after a positive report by Morgan Stanley forecasting growth in CV sales.

-

Celebrity Lifestyle7 months ago

Celebrity Lifestyle7 months agoEx-Cricketer Shikhar Dhawan Buys Ultra-Luxury Apartment Worth ₹69 Crore in Gurugram

-

Crime & Investigation5 months ago

Crime & Investigation5 months agoDelhi Police SI Neetu Bisht Caught Taking ₹20 Lakh Bribe – Shocking Details Emerge in Corruption Probe

-

Glamour & Entertainment6 months ago

Glamour & Entertainment6 months agoTelegram Channels Disseminating Pro‑Russian Propaganda in Poland

-

Entertainment6 months ago

Entertainment6 months agoAbhijeet & Dr Tarika Reunite in CID 2 — Fans Say ‘Clear the Misunderstanding Now

-

Business6 months ago

Business6 months agoAmazon sets 30‑day relocation deadline for corporate staff—opt out by resigning in 60 days

-

Bollywood4 months ago

Bollywood4 months agoNo ₹3 Lakh Fine or 2-Year Jail: The Truth Behind the ‘Hakla’ GIF Buzz

-

Celebrity Lifestyle6 months ago

Celebrity Lifestyle6 months agoMaha Kumbh Girl Monalisa seen in car allegedly worth ₹1 crore

-

Travel & Adventure6 months ago

Travel & Adventure6 months agoBest Places to Hangout in Delhi (2025): Top 10 Picks for Fun & Chill